Get 50% off your first tax consultation with The Accounting Creative, the top-rated accounting service in Illinois

Fill out the form and we`ll be in touch with you shortly.

About the company

Welcome to The Accounting Creative, the premier accounting services company in Illinois. We offer a comprehensive range of services including bookkeeping, tax preparation, and financial analysis to help businesses and individuals achieve their financial goals. With our team of experienced professionals and cutting-edge technology, we are committed to providing top-notch accounting solutions tailored to your specific needs. Contact us today to learn more about how we can help you grow and succeed.

Our advantages

Streamline your financial processes with our expertly managed accounting services

Maximize your profits and minimize your losses with our comprehensive financial analysis

Trust in our accuracy and attention to detail to keep your books in perfect order

Get 50% off your first tax consultation with The Accounting Creative, the top-rated accounting service in Illinois

Fill out the form and we`ll be in touch with you shortly.

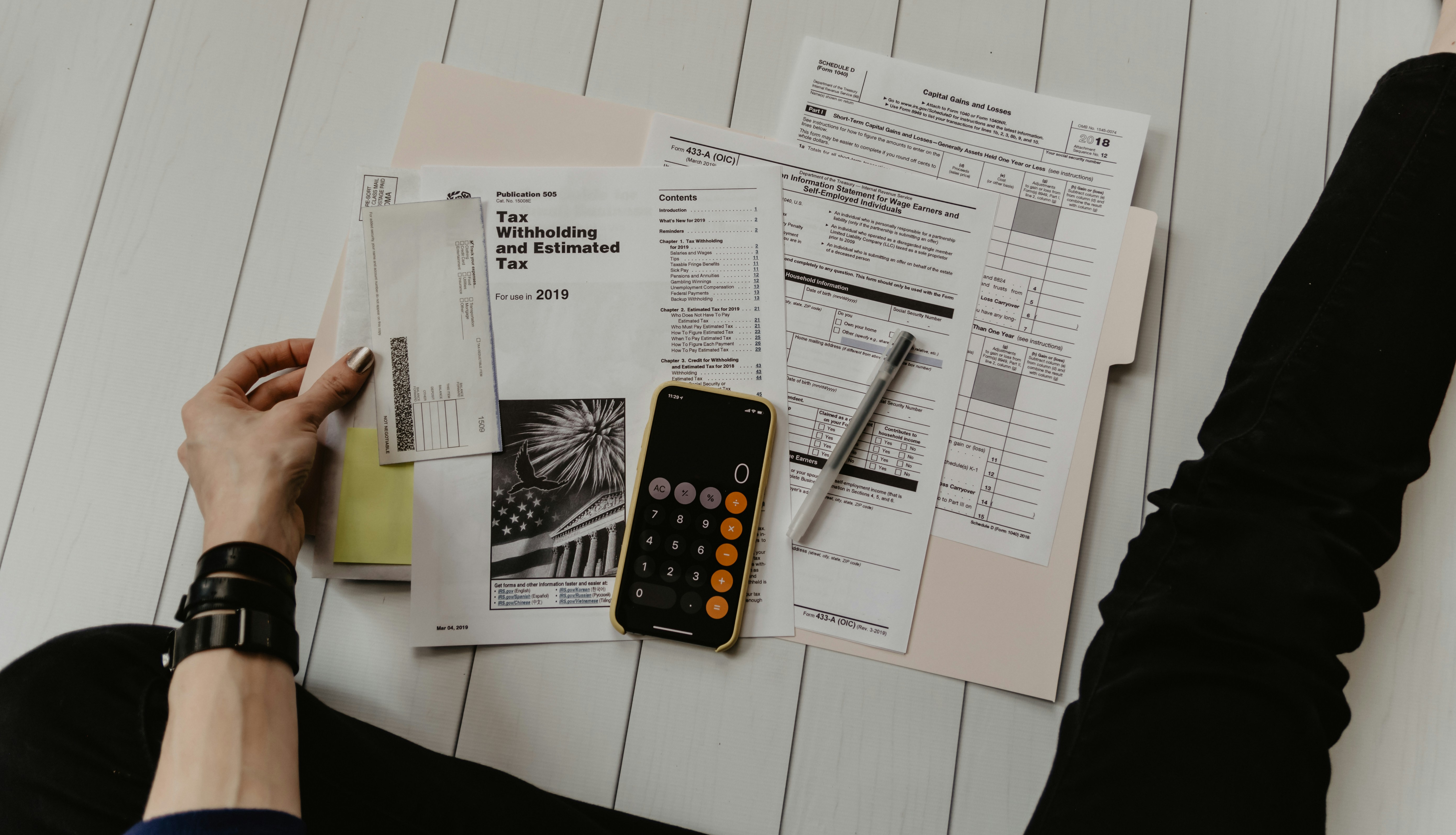

Photos and videos

How it works

Visit the website of The Accounting Creative

fill out the contact form with your information

and wait for a representative to reach out to you.

Get 50% off your first tax consultation with The Accounting Creative, the top-rated accounting service in Illinois

Fill out the form and we`ll be in touch with you shortly.